How Ryobi Became the Top Brand in Outdoor Power Equipment

The Outdoor Power Equipment market is extremely competitive, with over 250 brands vying for market share. Despite this, Ryobi, a Home Depot exclusive, has managed to come out on top, holding onto ~20% market share for the past two years.

Outdoor Power Equipment Market Share

United States | Online and B&M Sales at Home Depot and Lowe’s | Jan 2021 - Dec 2022

In general, the Patio & Garden industry is very seasonal and the Outdoor Power Equipment category also follows this trend. Therefore, strong performance in key selling months is crucial to brand’s success.

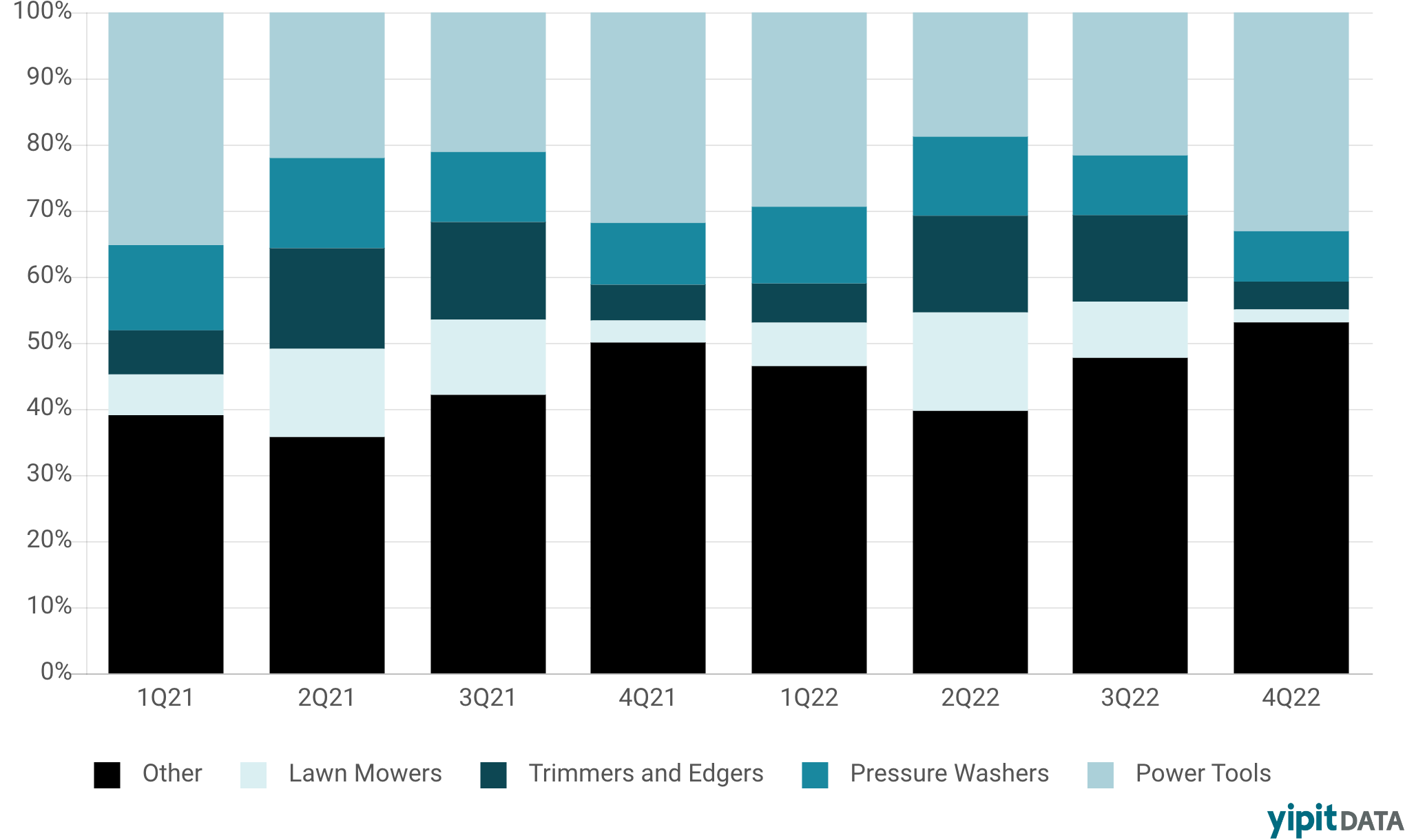

Ryobi has focused its product line against key subcategories with Power Tools, Trimmers & Edgers, Power Tool Accessories, and Pressure Washers typically comprising 50%+ of total sales. Ryobi Power Tools alone comprised ~23% of the brand’s total $4.3B GMV sales in 2022.

Ryobi Brand Share of Sales by Category at Home Depot

United States | Online and B&M Sales at Home Depot | Jan 2021 - Dec 2022

So what’s next for the Techtronic Industries (TTI), cordless power tools giant? Winter months may represent a growth opportunity for Ryobi, as their market share has historically weakened in 1Q. However, their continued focus on key sub-categories will likely ensure their continued success.

For custom insights in Patio & Garden or other Home Improvement industries, reach out to insights@yipitdata.com.

Source: In-Store Receipt Data, Proprietary Email Receipt Data, Webscraped Data

Curious to stay up to date on the latest trends in retail? Subscribe to our blog.